Vital stats

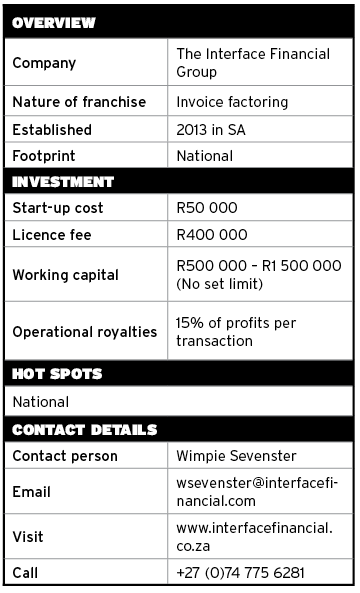

- Player: Wimpie Sevenster

- Franchise: The Interface Financial Group

- Established: 2013 in SA

- Contact: +27 (0)74 775 6281

- Email: wsevenster@interfacefinancial.com

- Visit:interfacefinancial.co.za

Whether small businesses are trying to expand or fighting to survive, cash flow is always an issue. Regardless of whether the economy is struggling or booming, businesses are always in need of cash.

Brief history of The Interface Financial Group

Interface, like the financial services industry of which it is a part, is a very mature player. Having been in business since 1972, Interface is clearly the market leader in invoice discounting.

It has hands-on experience and a growing network of offices in the United States, Canada, Mexico, Australia, New Zealand, the Republic of Ireland, Singapore, the United Kingdom and, of course, South Africa.

For the first 20 years of its operations (before franchising), Interface acted as an invoice discounter. This activity has resulted in a very solid knowledge base from which Interface franchisees/licensees can draw support.

Senior management of Interface have ‘been there and done that’ — their experience now translates into your franchise/licence success story.

What does IFG do?

The Interface Financial Group offers factoring services. Importantly, this isn’t the same thing as lending money. Simply put, an IFG licensee buys an asset, and the asset that’s bought is an accounts receivable that is evidenced by an invoice.

The IFG licensee buys this at a discount from the face value and holds it until maturity, usually about 40 days. At the end of the credit period they receive payment of 100% of the face value and, therefore, the discount is taken as income, which is their gross profit in the transaction.

Your client’s customer pays the invoice in full directly to you on the due date. Your working capital goes to work the moment you purchase an invoice, and it offers an above-average return on your capital with minimal marketing and a work schedule that is within your control.

Why do you need an IFG licence to do this? Isn’t this something that you can do on your own?

Absolutely. This is something that anyone can do. However, in the same way that there’s a great advantage to opening an established fast food franchise store, IFG offers the training and support needed to get up and running quickly.

The Interface Financial Group is an international operation that’s been around since 1972. It has also been given ‘World-class Franchise’ status by the Franchise Research Institute.

We like to say that IFG allows licensees to be in business for themselves, but not by themselves. Licensees benefit from a proven model, operating system and support structure. It offers an exceptional training programme, a powerful start-up marketing programme, ongoing transaction support and international invoice discounting opportunities.

Lastly, licensees benefit from the Interface Risk Management Programme, which has been perfected over more than 40 years, and is a key reason why IFG licensees all over the world are incredibly successful.

With many franchise/licence opportunities out there, what makes IFG uniquely attractive?

There are a lot of factors that make an IFG licence attractive. Firstly, start-up costs are low and there are no pre-set capital requirements. Secondly, you don’t need to hire employees and you don’t need a shop front, or even an office. This is an operation that can easily be run from home.

The Interface licence is designed as a home-based business concept. A home-based office is usually more economical than renting office space. We do not, however, mandate that you must be home-based. It is a matter of personal choice. Are you comfortable working at home, and does the home environment lend itself to a professional office?

The small business market keeps growing, and that increases the number of small businesses that need cash flow assistance. A wide range of industries and markets benefit from invoice discounting, including manufacturing, construction, distribution and professional services.

An uncertain economy does not affect your business, because you are there for small business owners when traditional banking institutions cannot help.

However, you do not compete with large financial institutions. Instead, you work alongside them to provide short-term solutions that they cannot assist SMEs with. A lot of our clients are referred to us by banks, business brokers, lending institutions and accountants.

How do IFG licensees go about finding clients?

We have found that the best clients come from referral sources. We have, therefore, created a professional marketing approach that does not rely on cold calling and ‘selling’ to an end user. We train our franchisees/licensees in the art of forming a ‘Lead Source Referral Group’ that will supply the bulk of their business.

In the majority of locations, where Interface licensees operate, that group consists of three basic components: Banks, non-bank lenders and accountants that run small business practices.

Interface franchisees do not ‘sell’ the service. A typical marketing approach is to work with a lending officer of a local bank. We request a meeting time, by appointment, of only 15 or 20 minutes.

During that meeting, we explain who we are and what we do. We are mindful of showing that we are not in competition with the bank, and simply ask for referrals when the bank is unable to accommodate their customers’ business funding needs.

This approach allows the bank to continue supplying their regular services and maintaining a deposit relationship, while Interface handles the funding requirement.

At some future time, the client will become ‘attractive’ to their bank, from a lending point of view, and the bank will then take over the funding role.

Banks are in the business of providing services to their clients. Those services vary and may be readily available, or not available, due to the incompatibility of the applicant.

Where they are not available, the bank then becomes a ‘problem solver’ for their customer by referring that aspect of the business need to Interface.

Who is the ideal IFG licensee?

There is no such thing as a universal description of an Interface licensee. There are, however, several significant characteristics that all IFG franchisees have. First, we always look for individuals who have excellent communication skills — both verbal and written.

Interface licensees are charged with the task of communicating with professionals such as bankers and accountants on the one hand, and with small business owners and entrepreneurs on the other.

Interface clients are by nature very entrepreneurial individuals who are striving to get their business venture up and running as quickly as possible. Because the business is in its early development stage, the owner is probably handling numerous responsibilities within the organisation. Licensees need to be able to effectively communicate with these individuals in order to obtain the required information and also to work with them on an ongoing basis.

Second, we look for individuals who are decision-makers. Licensees gather and analyse the information, confer with Head Office, and then make a decision to move forward or not. Our process is designed to be handled quickly, efficiently, and in a professional manner.

Finally, we seek to work with licensees that are entrepreneurial in their outlook. We look for people who have a vision for themselves and their Interface business.

Is a background in business or finance a must?

A background in business will certainly never hurt, but it is by no means a must. The list of successful IFG licensees is incredibly varied.

We have licensees who come from all walks of life. But what they all have in common is drive, a good head for business and great communication skills.

It also helps to have some ‘number crunching’ abilities, but it is not imperative, since our detailed system will easily walk you through the process and procedures.

Our personalised training programme will also ensure that you grow to understand the Interface system. Part of what we bring to the table is a comprehensive transaction tracking system that takes care of all of the monthly chores in terms of creating your income and expense statements and your monthly balance sheets.