Content in this guide

- Business plan

- Zoning

- Title Deeds

- Find out who owns the land

- Financial support

- Building regulations

- Join the NHBRC

- Grading levels

1. Business plan

In the business plan you also have to discuss how you intend to cope with the proposed electricity tariff increases and allow for possible interest rates hikes which would affect the profitability of the project.

Another important issue which must feature in your business plan is the cost of managing, maintaining and securing the residence.

Any organisation that is providing millions of Rand to develop such a project will need to be sure that the residence will at all times be properly maintained and is secure.

Without a sound business plan, you’ll be unable to find funding. It’s important to remember that a business plan is more than a means to money; it’s also the blueprint of the business and the best way to test whether or not the business is feasible.

You must show clearly in the business plan that you have researched the market thoroughly and are able to show that the students (who are always short of money) will and can afford to rent the accommodation as they are the key to the success of the project.

2. Zoning

Make sure that the property is zoned for this type of accommodation. Zoning is the grading of properties in terms of what it can be used for and what can be built on that property. Zoning schemes are imposed by Provincial Legislation and administered by Municipalities.

Zoning is the grading of properties in terms of what it can be used for and what can be built on that property. Zoning schemes are imposed by Provincial Legislation and administered by Municipalities.

South Africa’s laws require that in order to develop townhouses in a residential area the property must be zoned correctly (the property may only be zoned to develop one dwelling and not a number of different units).

If the property is zoned incorrectly, you have to apply for rezoning. Each local authority has different parameters in order to rezone property.

3. Title Deeds

In addition to the zoning regulations, development is also controlled by conditions of title. These conditions are set out in the Title Deed of each property, and can restrict the way in which a property may be developed.

Any development of land that ignores this legislation and its regulations can result in prosecution in terms of the applicable legislation.

The zoning regulations as well as the property description, and the size, orientation and other details can be obtained from the local municipally office and this department can also provide information regarding the National Building Regulations.

If a proposed townhouse development needs to re rezoned the application is a formal procedure. As it is a very complex procedure, it is best to consult a professional town planning consultant or other professional such as a land surveyor or a lawyer.

There are other costs to worry about as well. These include preparing the application, i.e. professional fees, the application fee charged by the council and the cost of drawing up plans.

Depending on the type of application, obtaining a decision may take as long as 12 months.

After the application is submitted it is circulated to relevant Council departments and agencies for comment.

Find out who owns the land

You will also have to find out who owns the land. Every property in South Africa has to be registered with the Deeds Registries Office in South Africa.

The deed constitutes proof of who owns the property. The deeds office keeps a record of all property transactions. If a title deed is destroyed or lost, application can be made to the deeds office for a duplicate original of the deed.

4. Financial support

As this is an education project, contact the Small Enterprise Development Agency, who provide free mentorship and guidance that will help will all the important steps in starting a successful business.

They will point you in the right direction in order to find funding and may also be able to help you get funding through the Department of Education.

However, although they do not fund projects, they will certainly be able to refer you to the right institutions. Other funders include:

NEF Imbewu Entrepreneurship Finance

They provide risk capital to new businesses in the property development arena. Visit their website for more information.

IDC – Healthcare and Education Fund

This fund supports education. Applications for financial assistance are evaluated primarily for economic merit (viability), while collateral is a secondary issue. The policy is to have interest rates between 2 below- and 5% above prime overdraft rate. Download the pdf here.

Umsobomvu Youth Fund

Enterprise Finance aims to promote entrepreneurship among young people, so it provides funding to the youth (18-35 years old) to help them start a new business or grow an existing one. However you will have to demonstrate commitment to the venture and that it will be economically viable. Visit the website here.

5. Building regulations

It is widely known that the regulations for the building industry in this country are far less stringent than those of other countries.

A good reputation is so important

A reputable developer will never cut corners when building. By law certain standards have to be met throughout the building process. Architectural plans must adhere to council regulations and be passed by the local municipality.

Approval

Foundations must be approved by a building inspector before concrete is cast; the structure undergoes a damp proof test, the roof structure has to be passed and when the building is complete it must pass a final inspection.

Building inspectors can make or break a development

No loan for the construction of townhouses will be authorised by a bank without a building inspector approved by the National Home Builders Registration Council (NHBRC) passing the structure. If you plan to sell townhouses and have cut corners, buyers will be unable to obtain funding to buy a town house.

The Builders Manual

Before you start building contact the NHBRC and arrange to get a copy of their guide, “The Builders Manual”. It is a complete guide to building and explains costing of materials, planning and just about everything you need to know.

Download ‘A Guide to the Home Building’ manual here.

There is no such thing as a free ride

There is software on the market which is designed to assist owner builders to effectively cost all aspects of construction including labour, materials and equipment. However, it’s unlikely that you will find free software that you can use effectively. Contact the NHBRC for advice.

6. Join the NHBRC

“Avoiding the professional services of a Quality Surveyor could be a foolish decision”, says Zweli Mtetwa, Public Relations Manager for the NHBRC.

“We can help. We look at plans and can advise the best route to take, discuss the right materials and check quotes to ensure that castings’ are correct and that the owner-builder is not being over charged. The only requirement is that the builder has to join the NHBRC. Registration with the NHBRC will also give builders credibility” advises Mtetwa.

Any enterprise that wants to tender work from the public sector in the construction industry, must register with the CIDB.

Before you can register with the Construction Industry Development Board (CIDB) you must have established your business and have a history of various construction projects under your belt.

For registration and membership fees – download the NHBRC registration form here.

The CIDB registration qualifies you for projects in the Public Sector

Any enterprise that wants to tender work from the public sector in the construction industry, must register with the CIDB. To register with CIDB your enterprise must be a registered business entity with theCompanies and Intellectual Property Commission (CIPC).

Register the work you have completed

You must register any construction work you have done. These include contracts for the combination of goods and services, extension construction, installations, repairs, maintenance, renewals, renovations, alterations, dismantling or demolition of buildings and engineering infrastructure.

These projects must be above R200 000 for public sector and R300 000 for private sector. This creates a track record for your business which you require to register with CIDB.

Finance is not the only criteria

Your company’s ability to finance a particular construction project does not automatically mean you will qualify for a project; you need to have solid experience behind you. Nor does a grading designation actually determine which project you will be able to do.

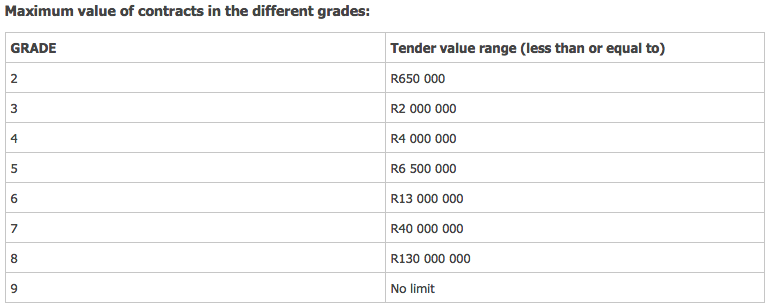

7. Grading levels

There are nine grading levels

The different grades show the size of contracts a contractor is capable of doing. This is based on financial and works criteria. The financial criterion comprises best annual turnover, track record, and available capital.

Works capability assesses a contractor’s track record and the number of qualified professionals in certain specialist categories (e.g. electrical).

Financial capability

This is evaluated in terms of the contractor’s best annual turnover during the past two years, the largest contract the contractor has performed in the past five years, and the value of the available capital that a contractor is able to secure in order to perform a construction contract.

Works capability

This area is evaluated in terms of the largest contract the contractor has performed in the class of works applied for, as well as compliance with statutory requirements (e.g. registration with the Electrical Contractors’ Board of SA).

The contractor must also have the required number of qualified professionals in their employ for the grade applied for. These can be either full-time employees or full-time equivalent.

There are various levels of CIDB Grading. Always apply for the level you are capable of:

A contractor can also apply for recognition as a “potentially emerging contractor”. Potentially Emerging status indicates that the contractor has significant development potential, but has impediments that must be overcome.